How To Open A Domiciliary Account In Nigeria

As an individual or a business owner, sending and receiving payment in a foreign currency is easier done through the domiciliary account.

Are you or a Freelancer, Influencer, Blogger, or a family member trying to receive fund in Foreign currency but worried about the bank conversation rate of foreign currency to Naira?. This is were Domiciliary Account commonly called a “dom account,” comes in handy.

A domiciliary account is a specific kind of bank account that allows you to receive and make payments in foreign currencies, including US dollars. All money in a domiciliary account is valued at the current naira exchange rate.

If you found the bank conversion rate not ok by you, DOM Account allow you to withdraw the foreign currency received by your Domiciliary Account from your bank and easily Trade the Currency to Naira at your desired rate.

Who can open a Domiciliary account?

Most banks allow both individuals and corporate bodies to open and operate a domiciliary account. As long as you have the necessary paperwork, including ID, address verification, Two referes, and the proper bank forms, you will be able to apply.

The application takes nothing more than 48 hours and you can start sending and receiving foreign currency with your DOM Account.

Why Open A Domiciliary Account

Domiciliary accounts are important if you want to start receiving money from abroad. You can easily open a dom account with most Nigerian banks and with it, you can enjoy the Benefits of possessing a Domiciliary Account.

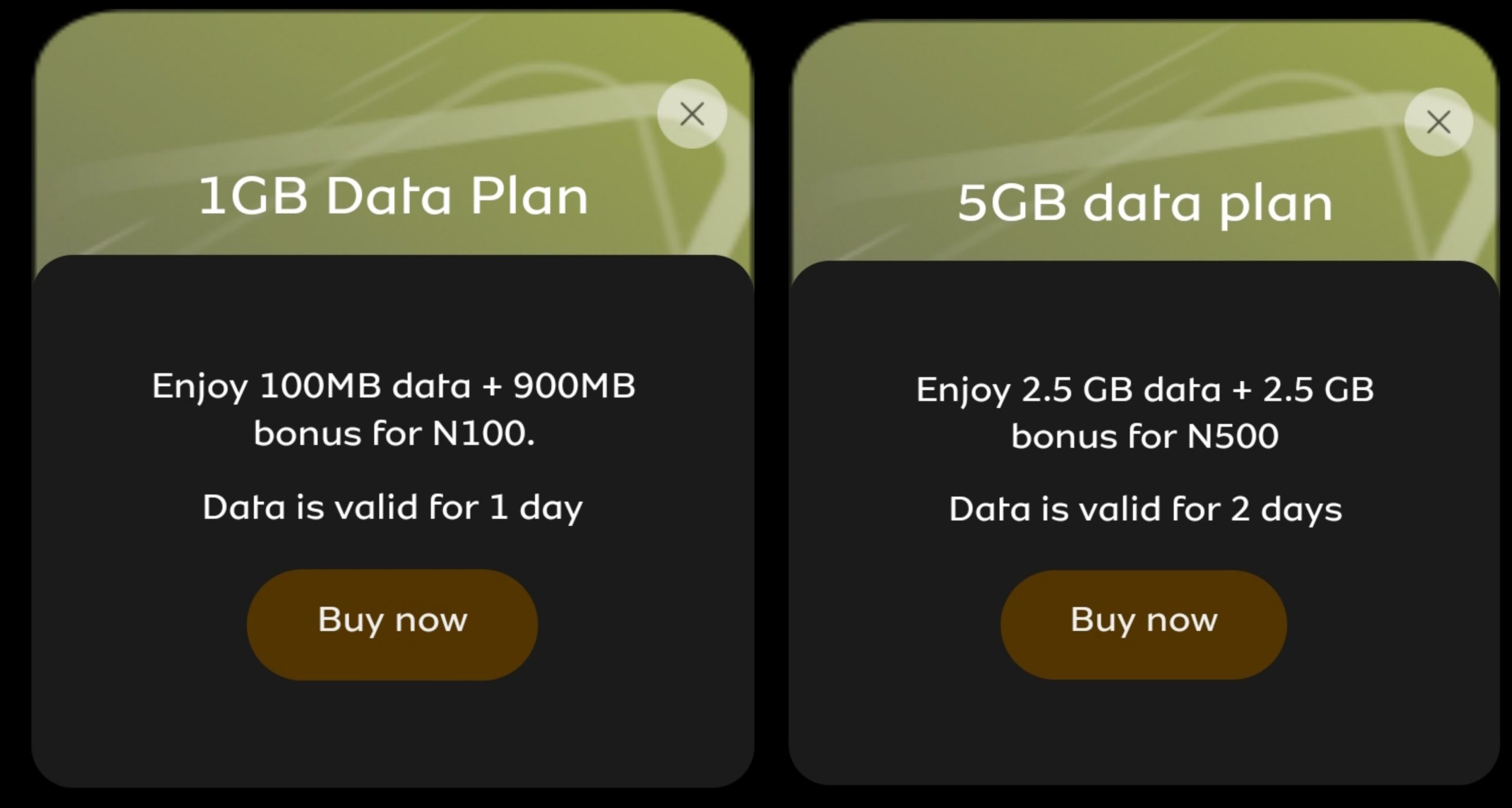

As at the middle of year 2022 in Nigeria, the Conversion Rate of Dollar 💲 to Naira is around N419 per Dollar due to CBN Foreign Exchange Regulation. Not to talk of the Black Market Rate which is around N610 per Dollar. Bank won’t trade with you without Gaining from you, Now imagine the amount of money your bank is gaining from you.

Let’s assume you are a Blogger, Freelancer or Influencer and received $100 via Wire transfer to your local bank account. You will receive a total amount of N41,900 whereas if you are to use your DOM Account to receive the $100 fund, You can be able to exchange it to N60,000 using the black market rate.

The benefits of having a dom account vary from one bank to another but usually include the following:

Pay For International Transaction — With Your DOM Account, you can pay for any foreign transaction anywhere in the country. You can send money abroad, renew your hosting plan, buy any paid software or purchase any game on Google PlayStore. This is one of the best things about domiciliary account for Freelancers, bloggers and businessmen.

Control Over Unstable Currency — It’s no longer news that Naira has been fluctuating over the years. The Naira exchange rate has been a course to worry about especially for those that import from foreign countries.

With a domiciliary account, you don’t have anything to worry about as long as you have a fund on your account you can buy and carry out any foreign transaction anytime any day.

Saving In Foreign Currency — Domiciliary Account allows you to save in US Dollars, Pounds Sterling or Euro And your money will be valued at the prevailing exchange rate.

Requirement To Open A Domiciliary Account

The following details are usually required by Nigerian banks to open a domiciliary account. Check with your bank before going to make sure you have the right documentation.

- Referees — Two current account holders (preferably with the same bank) to sign the reference forms. Must Not Be Salary Account.

- Duly filled domiciliary account opening form.

- An existing naira account with the bank. It can either be a savings or a current account.

- Valid means of identification: either an international passport, permanent voters’ card, National ID card, or a driver’s license.

- Passport photograph.

- Utility bill issued within the last 3 months.

- Minimum Opening Balance ($100)

How To Open A Domiciliary Account In Nigeria

To open a Domiciliary Account in Nigeria, all you have to do is to walk in to your Bank and request for a Domiciliary Account opening Form. You will be given two form to fill, one meant to be filled by you and the other for your Two Referes.

This referes can be Current Account Holder of Any Bank, the account must be at least 6 months old and must not be used for Salary Account. Below is the Example of GTB Domiciliary personal and Referes form.

Haven filled the personal form and your Two Current Account Holder have also fill and Sign the Referes Form, take the form back to the bank alongside with your Valid Means of Identification (Either an international passport, permanent voters’ card, National ID card, or a driver’s license), Utility Bill and At least Two Passport.

After submitting the form, they will cross-check your required details and ask you to go Home. If the Current Account of the two referes Qualify for the DOM Account opening, Your DOM Account will be opened Within 48 hours.

Once opened, you will be sent a message via the phone number you used to open account with the bank and your Domiciliary Account Number will be added in it.

You can now send and receive Foreign currency to and from anywhere in the world using your DOM Account Number.

Most banks in Nigeria allow you to open a domiciliary account, including the following:

- Guaranty Trust Bank (GTB)

- Zenith Bank

- Firstbank

- Access Bank

- United Bank For Africa (UBA)

- Plus, many more!

If Your bank is not listed here, you can visit them to make enquiry about the availability of Domiciliary Account.

How To Receive & Send Money From A Domiciliary Account In Nigeria.

To receive money to a domiciliary account in Nigeria you will need the following information…

- DOM Account number

- Name on the account

- Name of the bank

- Branch address of the bank

- Routing Number

- Swift Code. (You can Google the Swift Code of your Bank.)

To send the Money you will make use of the Online Banking or you can use the local Bank. Depending on the Bank, the steps are almost the same.

How To Withdraw & Exchange Fund In A Domiciliary Account

Once you have received a foreign currency into your DOM Account, you will be notified via message. Just visit your bank and withdraw the money by filling your foreign currencies withdrawal slip. After that you will receive your money in the currency, it can be dollar or euro depending on the type of domiciliary account that you opened.

Then you can proceed to change it to your local currency at the Bureau De Change. The Bureau De Change is an official place to meet buyers and sellers of foreign currency. There you can exchange your dollars for any currency both Naira or any other foreign currency.

Things To Note About Domiciliary Account

- You can use it to receive foreign currency from any part of the world.

- Your account will remain dormant if you didn’t receive the minimum opening balance ($100) within 6 months.

- You can withdraw the foreign currency using the foreign currency withdrawal slip from your bank.

- To Exchange the Foreign currency to naira, you can search for your City Bureau De Change location and walk in to exchange your Foreign currency.

Conclusion

Not only does Domiciliary Account Help you in receiving foreign currencies, it also allow you to have control over Unstable Currency.

With DOM Account, you no longer have to be cheated by your bank exchange rate as you can easily exchange your Foreign currency at your desired price Within the Black Market Rate.

Want to stay updated? Tap the below buttons to join our members now.

Do you have any issue setting this up? Use the comment box below to report any issue regarding to this post or any issue regarding to broken link on this post and you will be replied as soon as possible. You can also contact us on telegram.